To be eligible to receive retirement benefits, TRS law requires that a member terminate all employment with all TRS employers who have employed the member in a TRS-reportable position. This Fact Sheet is intended to help members and employers understand how termination of employment is established and how it could be “undone” by failing to comply with all requirements.

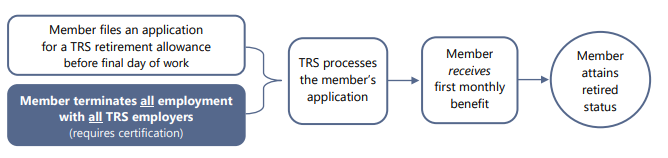

Termination of employment to be eligible for TRS retirement benefits is not determined as of a single point in time. As illustrated in the diagram below, termination of employment is just one step in the process of retiring. TRS must evaluate the entire process to determine whether a member’s termination of employment was valid.

After initially terminating employment, TRS members are strictly limited as to the timing and type of work they may perform on behalf of any TRS employer. For example, an agreement made before retiring to return to work for a TRS employer after retiring may mean the member has not terminated employment as intended. Similarly, a member who is working as an independent contractor or as a volunteer performing duties reportable to TRS, or a member

who still works for a TRS employer but in a position reportable to the Public Employees’ Retirement System (PERS), may not have terminated employment as intended.

Why is this important? Failure to comply with all termination requirements may result in the member being retroactively returned to active member status, thereby defeating the member’s intent to terminate employment and retire. The member would be required to repay any retirement benefits received, with interest. Further, the employer would be responsible to pay member and employer contributions to TRS, with interest, on any compensation that was paid to the member during or for the period of retroactive reinstatement to active member status.

Definitions and Examples

Termination of Employment means the member’s employment relationship with their employer has been fully and completely severed and all payments due upon termination of employment, if any, have been paid to the member. Upon termination of employment, the retiring member may not perform any work on behalf of a preretirement employer in any position or in any capacity until they have attained retired member status.*

This generally includes work performed as an employee of a third party or as an independent contractor/consultant and any work performed in positions not otherwise reportable to TRS. Modification of job duties or reduction in hours worked is not termination of employment.

Example: A TRS member stops teaching on May 10th, but she begins providing service to the school district as a bus driver on May 15th (prior to attaining retired member status). This member has not terminated employment, even if the modified duties would not otherwise entitle a person to active membership in TRS.

Date of Termination means the member’s date of termination of employment with the last TRS employer that employed the member in a position reportable to TRS. Most members will have been employed by only one TRS employer within the 12 months preceding the member’s retirement, while others may have been employed by more than one. The last date on which the member was or will be employed by any TRS employer is the member’s last date of termination and will be the date from which the member’s effective date of retirement will be determined.

Retirement application. The member must specify their last date of termination of employment, as defined above, on the application for a TRS retirement allowance.

Certification of Termination of Employment. The member and each TRS employer that employed the member in a TRS-reportable position in the 12 months preceding the member’s expected last date of termination has completed TRS Form 144 Member and Employer Certification of Termination of Employment*. TRS uses this information to

determine the member’s last certified date of termination.

Terminating employment as a substitute teacher

If the member’s preretirement service is partly or wholly substitute teaching, the member must terminate employment and complete TRS Form 144 with each TRS employer on whose substitute teaching rolls the member was listed within the 12 months preceding retirement, whether or not substitute teaching service was actually provided.

The member may not perform any work or provide any service on behalf of those employers after the member’s last certified date of termination and before obtaining retired member status.

Example: A teacher’s last day of work is June 10. Based on the information provided on Form 144, TRS confirms that June 10 is the member’s last certified date of termination, meaning his effective date of retirement is July 1. However, he begins working as a driver’s education teacher on July 15, before he has received his first monthly benefit, which means he has not terminated employment.

Prohibited Prearranged Agreement means an oral or written agreement between the preretirement employer and a member who has not yet reached age 60 (normal retirement age), entered into before the member has attained retired status, to again perform work on behalf of that employer, in any capacity, at any time in the future. This generally includes any work performed in a position that is not reportable to TRS and work performed as an employee of a

third party or as an independent contractor or consultant.

Example: A teacher and her employer agree that she will terminate employment and retire at the end of the school year at age 58 and will return as a part-time coach for the same employer at some point in the future. Because she had not reached normal retirement age as of her last certified date of termination, it is a prohibited prearranged agreement and she has not terminated employment.

Break in Service Requirement. A retired member may not again perform any work on behalf of any TRS employer in a position reportable to TRS, in any capacity, (except as may be allowed under TRS law), until after the member has completed a break in service. The required break-in-service period begins on the day following the member’s last certified date of employment and applies to any work performed in a TRS-reportable position as an employee of the TRS employer, as an employee of a third party, or as an independent contractor/consultant. A member who returns to TRS-reportable employment within their required break-in-service period has not

terminated employment.

Example: A teacher retires from District A after 30 years of service. Her last certified date of termination is June 12, 2024 and her effective date of retirement is July 1, 2024. During the summer she moves across the state and accepts a part-time position working as a paraprofessional with District B starting on September 1. However, TRS law requires that she wait 120 calendar days before resuming TRS-reportable employment. Because she has returned to work in a TRS-reportable position with another TRS employer within her required break-in-service period, this member has not terminated employment.

*Footnotes: TRS pays benefits on the last business day of the month. When the first monthly benefit has been deposited to the member’s bank account (if paid by direct deposit) or the member has cashed the first check, they have attained retired member status.

If one employer (e.g., a school district) has reported a member to TRS for service provided on behalf of another employer (e.g., an education cooperative), the member’s actual employer – the education cooperative, in this example – must certify the member’s termination date on TRS Form 144 Member and Employer Certification of Termination of Employment.

Fact sheet updated: June 8, 2020